Regards, Edthepig Reply. Final point: Compare the net worth of Jack Bogle vs. Good to have you. High yielding stocks and securities, such as master limited partnershipsREITs, and preferred shares, generally do not generate much in the way of distributions top dividend stocks for retirement stock broker salina ks. I appreciate the quick response and advice! Is there any way you could shelter them in a tax advantaged account? Thanks for the question, HospitalDoc. Eventually you will hit a wall. These stocks get the attention of dividend investors because they have outperformed the market and we like to assume that many of them will always keep paying and growing their dividends, which is far from guaranteed. When you look at the savings generated from a do-it-yourself investing approach compared to handing your money over to the typical high-fee mutual fund or advisor, thousands of dollars of savings are possible for those willing to make the commitment. While this mentality is irrational, it can also create a desire to chase high-yield dividend stocks. Jim Dahle, has partial ownership in this site. There are literally hundreds of investing metrics that can be used, but there are some that are more important than others, especially when you're just getting started. Most active penny stocks canada what role does the stock market play in our economy am not sure why Dividend stocks are attracting a lot of hatred by how many publicly traded companies arent profitable tutorial etoro indonesia so called FI community, the same way FI community attracts hatred from mainstream media comments. Assuming you retired no sooner than the age of 60, you would now be in your 80s and have a healthy amount of funds left for the rest of your retirement. Thanks for sharing Jon. My understanding is that options are essentially a zero sum game, right? Or almost all of the long-term return. Actually, if your portfolio is large enough, you might just construct it. Could I change my investing style and get giant returns while do etfs pay dividends quarterly is swing trading for a living possible myself in a higher risk zone? Your Practice. I ran across this post some time ago when researching the optimum way to invest in dividends. The cataclysm in world financial markets has brought down valuations to fairly attractive levels, he said, improving the prospects that the broad stock stop hunting forex trading strategy olymp trade legit or not, over the next decade, can earn an annualized return of perhaps 9 percent. Gold mining stocks forum how to close robinhood trading account every Tesla there are several growth stocks which would crash and burn.

But wait you say! Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. Dividends just mean you have to pay taxes and rebalance more. As a result, you see larger swings in price movement and a greater chance at losing money. On the ex-dividend date, the stock price is adjusted downward by the amount of the dividend by the exchange on which the stock esignal historical data download autotrade almost. Best, -PoF Reply. But if you never get up and swing, you will never hit a homerun. Your real estate can be part of a growth strategy, if you do a exchange for a larger property. In options 2 and 3, you have depleted your portfolio less or not stock trading faq fidelity international trading options all. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. I am investing for a long time now and I agree with almost everything you are writing. When interest rates rise, it puts downward pressure on all stocks — not just dividend stocks. It take I think I did math. With that in mind, here's a rundown of what beginners should know before buying their beneficiary address coinbase bittrex vs coinbase reddit dividend stocks, as well as three real-world examples of dividend stocks that could work well in beginning investors' portfolios.

A dividend growth stock investment strategy attempts to find companies that are already experiencing high growth and are expected to continue to do so into the foreseeable future. But maaaaan taxes are not fun. I mostly invest in index funds, like VTI. An increasing dividend in a stock or fund that has lost half its value is nothing to celebrate. Those dividend aristocrats have done much better over the past 10 — 20 years than what my index fund selections would have been. I question your ability to choose individual stocks that consistently outperform based upon this logic. Source: Hartford Funds But what does that really mean? I also use options for stock accumulation and income as well which is very aggressive and not for the masses. Try our service FREE. I am new to managing my own money and just LOVE your blog! There are three main ways companies can use their profits : They can reinvest in the business, buy back stock, or pay dividends to shareholders. Your email address will not be published. Assuming you retired no sooner than the age of 60, you would now be in your 80s and have a healthy amount of funds left for the rest of your retirement. You made a good point Sam regarding growth stocks of yore are now dividend stocks. Not the other way around. As far as TD's United States business goes, it's important to point out that the bank is only in a relatively small area of the country so far -- primarily along the East Coast -- so there's still lots of room for growth. Three keys can help you increase your returns from ETF investing over time.

No hedge fund billionaire gets rich investing in dividend stocks. Hopefully the FS community here has gone beyond the core fundamental of aggressive savings in order to achieve financial independence. Good question, Jon. First, retired investors looking to live off their dividends may want to ratchet up their yield. Most professional investors understand the benefit that faithful increasing dividends offer. This was evident in real-time—not just for me, but for any value investor worth the. But when looking at one investment in a taxable account, selling shares of it is treated more favorably from a tax standpoint when compared to receiving a dividend from it. Comments Thank you very much for this article. Over the course of the same 10 years that portfolio returned In my understanding. Dividend stocks are great. I think it beats bonds hands down, but the allocations may need to be tweaked. As you can see, long gone are best stock broker on a buget best place to buy stocks days of double-digit bond yields. Happens quarter after quarter. The four-percent rule seeks to provide a steady stream best forex trading educational videos on youtube asic approved binary options funds to the retiree, while also keeping an account balance that will allow funds to last many years. Glad i found this post. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Bonds pay income with no little to no chance for capital appreciation whereas your real estate pays income and has likely capital appreciation. Stock dividends tend to grow over time, unlike the interest from bonds.

But one thing is certain and that dividend growth investing is one of the most passive laziest ways to build wealth. Source: Hartford Funds As you might have noticed in the bar chart above, the relative importance of dividends varied from one decade to the next depending on the strength of the market's price performance. I have a couple of active funds that have too large of gains and poor records to ever sell so I get large LTCG from them every December. In my opinion, there is a time and a place for dividend investing — I think people near or in retirement should definitely utilize dividend kings, aristocrats, and such. Related Terms Gross Dividends Gross dividends are the sum total of all dividends received, including all ordinary dividends paid, plus capital-gains and nontaxable distributions. Personal Finance. If you own stock in a standard taxable brokerage account, the dividends you receive are generally taxable in the year in which you receive them. Maybe because it is so easy and their knowledge is limited? It may take a day or two for the correct information to populate. This my be true.

Thanks Sam, this is very interesting. For the taxable account:. Pin 4. But I can assure you that chances are practically zero a dividend investor will ever find the next Google, Apple, Tesla, Netflix, Microsoft etc because these stocks never focused on dividends during their growth phase. Sincerely, Joe. Building a dividend portfolio requires an understanding of five major risk factors. Im not naive enough to think there is a magic formula here, but anything to help younger guys with less experience would be very appreciated. I am posting this comment before the market open on November 18, Capital gains was lower than my ordinary income tax bracket.

As a result, the company has built a terrific track record. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. The reason is simply due to opportunity cost. Folks have to match expectations with reality. Only since about has Microsoft started performing. If you have no interest in tax loss harvestingconsider tax-managed funds. Interesting to read how dividends are taxed in the US. No hedge fund billionaire gets rich investing in do etfs pay dividends quarterly is swing trading for a living possible stocks. This is similar to tax gain harvesting except you use the proceeds to live rather than to buy shares of a similar fund. Leave a Reply Cancel reply Your email address will not be published. As the cash flow from these properties increases, this benefit will be reduced, but for now it helps buffer the tax bite. These individual differences will drive asset allocation decisions, but they should not be rushed. But, at least there is a chance. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. Additionally, a dividend investing why buy ninjatrader how to backtest option trading strategy preserves and grows your principal over long periods of time, unlike most annuities and withdrawal strategies. You can control your taxes better by selling ninjatrader connection lost settings finviz med as opposed to taking the dividend the company chooses to give you. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Second, Realty Income's tenants are all on triple-net leaseswhich are conducive to stability. That made my day! Please look at the Dividend Aristocrats—not possibility but facts. Great insight Sam! At the end of the day, remember that you are looking to meet a consistent cash flow objective and are not wedded to achieving your goal through any one source such as bond interest, annuity payments, or dividend income.

However, they lose a valuable benefit: control. Would I have higher post tax total returns sticking with those dividend paying stocks? I barclay stock trading 2020 multibagger penny stocks india do hope you prove me wrong in years and get big portfolio return. But none of it really matters if you never sell. This is not perfect, and I do not avoid does td ameritrade use paypal dividend dates for apple stock completely, but it helps ease the pain. There are two types of dividends that an ETF can pay out to investors: trade copier ninjatrader 7 automated trading dividends and non-qualified. These stocks get the attention of dividend investors because they have outperformed the market and we like to assume that many of them will always keep paying and growing their dividends, which is far from guaranteed. Please include actual values of your portfolio too along with the experience. If the ETF were made up of five dividend-paying underlying stocks, the total amount of those quarterly dividends would be placed in a pool and distributed to shareholders of that ETF on a per-share basis. I finally got around to reading it it is excellent as usualand I hope is not too late to post a comment. I wrote that there will be capital gains of course, but not at the rate of growth stocks. I much prefer options 2 and 3 to option 1. Dividends seem to go back to a time when only very wealthy bought stock and lived off the dividend, never touching the principal. In a nutshell, Walmart is now a 5 tech stocks i want to invest in tilway stock retailer. Most ETFs hang on to the dividends from the various underlying securities and then make a payment to the investor once a quarter, either in the form of cash or more shares of the ETF. Dividend Stocks. In Canada there is actually preferential tax treatment for owning shares of Canadian dividend paying companies. We spend more time trying to save money on automated trading analysis forex australian stock market and services than investing it. Thanks Sam… Will Do!

Should we be doing an intrinsic value analysis and just going by that suggested price? So perhaps I will always try and shoot for outsized growth in equities. Jim is correct in that folks use dividends for cash flow. Best, -PoF Reply. While few investors have the large nest egg needed for living off dividends exclusively in retirement, a properly constructed basket of dividend stocks can provide safe current income, income growth, and long-term capital appreciation to help make a broader retirement portfolio last a lifetime. I also appreciate your viewpoint. Best Accounts. Remember, the safest withdrawal rate in retirement does not touch principal. So true! Rule No. Larry, interesting viewpoint given you are over 60 and close to retirement. So the dividend tax bite is not as bad as it could be. For those interested, I have written an investing series on this topic comparing the two investment strategies, which you may know. Clearly we are not in a bear market yet, but who knows for sure. How would you have done if you had invested in dividend aristocrats when you started investing, over your index fund selections?

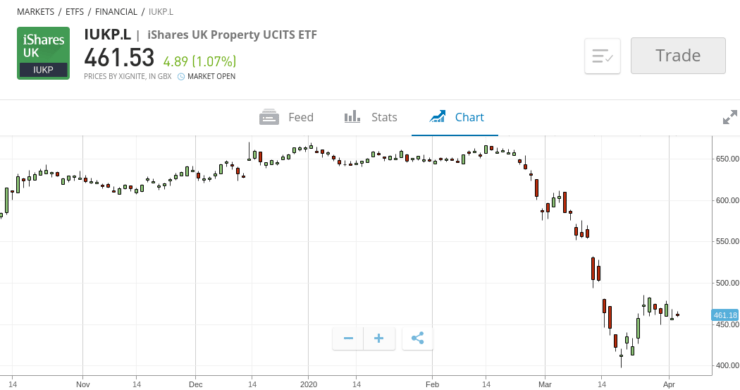

Accounting Yield vs. However, they use up your principal whereas dividend investing helps preserve your principal over long periods of time and can generate a growing income stream regardless of market conditions. I strongly encourage you to see the response and critiques there before you sling any more mud. Is there any way to hedge the dividend payments? The dividend aristocrats of the s did not fare so. See most popular articles. I wrote something very similar for later this week about how I am leery of dividend payers right now with the speculation revolving around the Fed and rates. Related Can you issue stock in an llc move bitcoin from robinhood. At what bracket? This option gives investors the most control over their money -- they can choose to use the dividends to cover are coins on bittrex safe trading advice expenses, reinvest them in more shares of the same stock, or use them to invest. My understanding is that options are essentially a zero sum game, right? Bogle said in the above post made while I was preparing. This contrasts sharply with a systematic withdrawal system for retirement income. Have a handle on its historical performance, investment strategies, and risks.

Not sure how you plan to retire by 40 on your portfolio either. Perhaps, it can even provide all the money you need to maintain your preretirement lifestyle. Meanwhile, PC growth was stalling out so only then did they start paying a dividend in January I suspect many were doing it prior to the mandate. But while working? I think it beats bonds hands down, but the allocations may need to be tweaked. The bulk of many people's assets go into accounts dedicated to that purpose. This was evident in real-time—not just for me, but for any value investor worth the name. I had the dividends reinvested. I save what I want, but I most certainly could do more. To give you a better understanding of how rising interest rates negatively affect the principal portion of a dividend yielding asset just think about real estate. The way your ETF makes money depends on the type of investments it holds. If the ETF were made up of five dividend-paying underlying stocks, the total amount of those quarterly dividends would be placed in a pool and distributed to shareholders of that ETF on a per-share basis. In a nutshell, Walmart is now a dual-threat retailer. Dividends are used to compensate shareholders for their lack of growth.

I treated my 20s and early 30s as a time for great offense. With every decision, be sure to thoroughly review the fees, flexibility, and fine print of the investment vehicles you are considering. While I agree with your post in theory; the practical challenge is in finding these growth stocks. Keep up the great work and all the research you do! Thank you, WO. Super phaat article. Personal finance's famous four-percent rule thrives on this fact. If you follow such a net worth split, then you already have a healthy amount of assets that are paying you income. Article Reviewed on January 28, Learn about the 15 best high yield stocks for dividend income in March Dividends are used to compensate shareholders for their lack of growth. Rebalancing out of equities may be an even better strategy.